Publish Time:December 17, 2019

2022 Rotary Kiln Technology Development Report

1、 Development of China's economy and lime related industries

1. Overview of China's Economic Development in 2022

In 2022, facing multiple unexpected factors, China efficiently coordinated epidemic prevention and control as well as economic and social development, maintaining overall economic and social stability; In the three years since the pandemic, the annual compound growth rate of gross domestic product (GDP) has been 4.5%, ranking among the top among major global economies. In 2022, the Chinese economy is facing triple pressures of demand contraction, supply shock, and weakening expectations, with the industrial economy growth rate falling below the pre pandemic level.

2. Development status of lime related industries

(1) The main demand industries for steel, alumina, and calcium carbide all have increased production

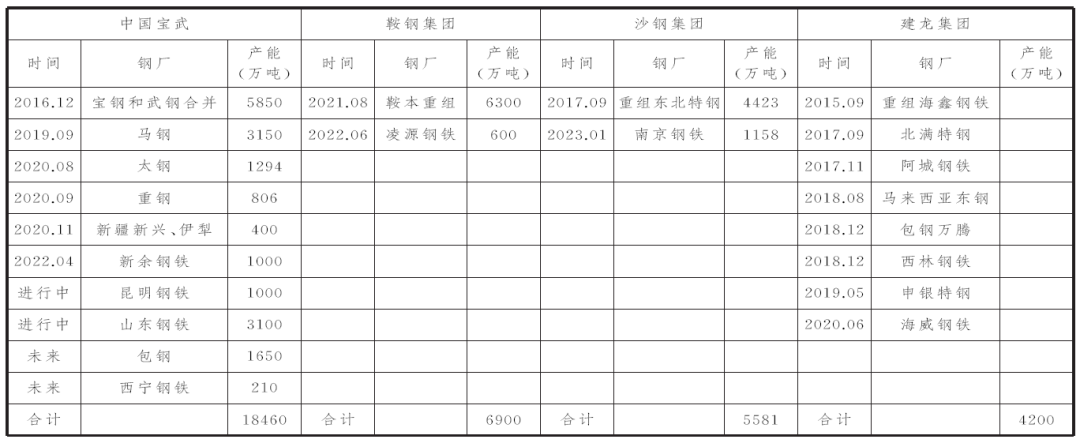

1) Steel: In the past decade, the wave of cross regional and cross ownership mergers and acquisitions in the steel industry has swept across the country, especially with the continuous acceleration of strategic restructuring based on specialization, aimed at reducing homogeneous competition, and characterized by asset transfer, building a new industrial pattern with the main framework of "Nanbaowu and Bei'angang". CITIC Taifu Special Steel Group has restructured Qingdao Steel, Hualing Xigang, Zhejiang Steel Pipe, and Tianjin Steel Pipe, With an annual production capacity of over 14 million tons of steel, it has become the largest and most comprehensive specialized special steel production enterprise in the world, and truly a leading global special steel enterprise.

Table 1: Enterprises with Active Mergers and Reorganizations in Recent Years

According to data from the China Iron and Steel Industry Association, the proportion of crude steel production in China's top 10 steel enterprises has increased from 35.9% in 2016 to 41.5% in 2021, but overall it is still at a relatively low level, lower than that of the United States, Japan, South Korea, and others.

According to data from the China Iron and Steel Industry Association, the proportion of crude steel production in China's top 10 steel enterprises has increased from 35.9% in 2016 to 41.5% in 2021, but overall it is still at a relatively low level, lower than that of the United States, Japan, South Korea, and others.

In the first three quarters of 2022, the steel industry fell into another predicament and prices were deeply lowered. From January to September, the national crude steel consumption decreased by 4%, but there were differences among different varieties. The demand for threads decreased by 15.8%, the demand for hot rolling decreased by 4.3%, the demand for cold rolling decreased by 2.4%, the demand for medium and thick plates increased by 1.6%, the demand for long materials decreased, and the demand for plates increased and decreased, reflecting the active adjustment of the economic structure.

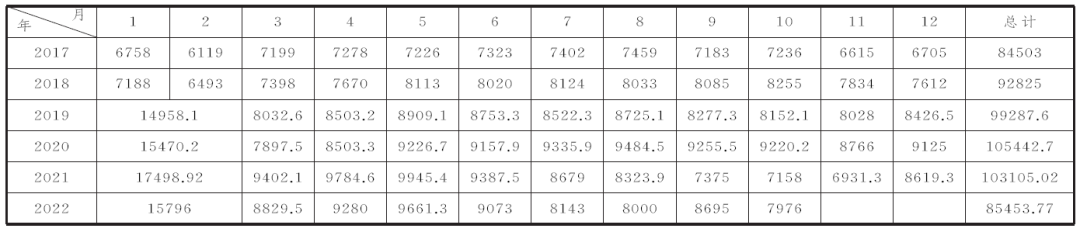

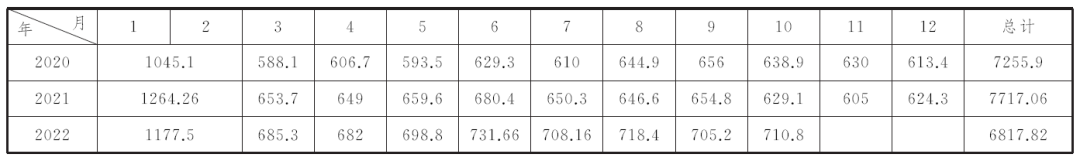

The statistics of crude steel production from 2017 to 2022 are shown in Table 2. It is expected that the cost of steel raw materials in 2023 will show a downward trend compared to the previous year. The average price of the iron ore index may remain around 85 US dollars, a decrease of 26%, while the average price of the coal coke index will remain around 1600 yuan/ton, a decrease of 30%. The overall steel price first decreased and then increased, with an annual average price dropping by 15%.

According to 2021 statistical data, China's pig iron production is 86.8568 million tons. Calculated based on the consumption of 85kg of lime per ton of iron, the annual consumption of stone ash is 73.82828 million tons. The crude steel production in 2021 is 10310.5 million tons, and based on the consumption of 38kg of lime (including refining) per ton of steel, the annual consumption of steelmaking lime is 39.18 million tons; The market capacity of metallurgical lime in 2021 is 113 million tons. It is expected that the demand for steel in 2023 will remain unchanged compared to 2022, with a crude steel production of approximately 1.02 billion tons and a total demand for lime of approximately 111.9 million tons.

Table 2 Statistical Table of Crude Steel Production from 2017 to 2022 (Unit: 10000 tons)

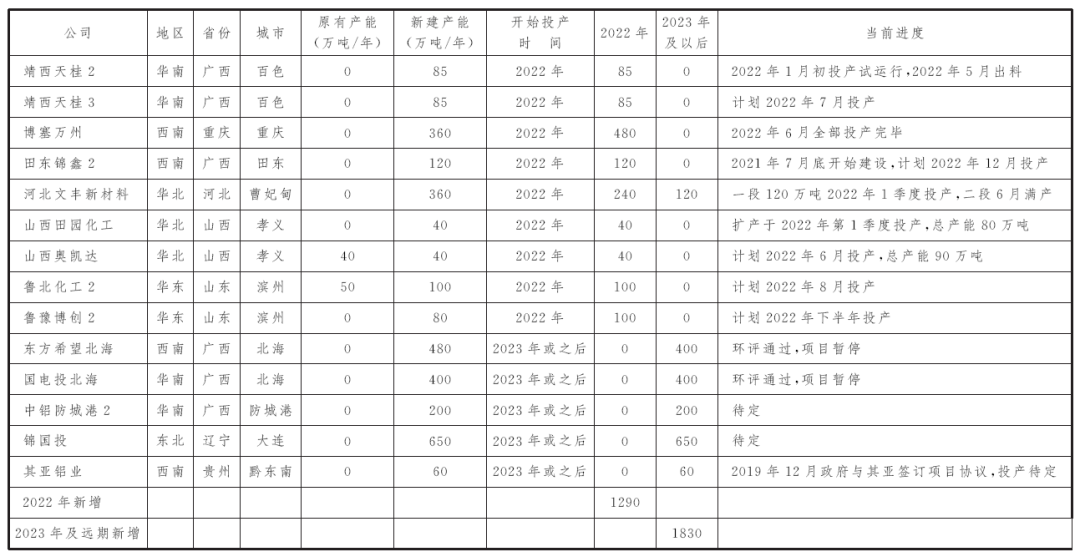

2) Aluminum oxide: In the first half of 2022, the overall supply of domestic aluminum oxide is abundant, and a large amount of new production capacity is concentrated and released. As of the end of May, the domestic alumina production capacity was 94.17 million tons, an increase of 5.2% compared to the end of December last year, and the operating capacity was 82.4 million tons, an increase of 12.3% compared to the end of December last year. The alumina operating rate was 87.5%. Affected by a significant increase in production capacity, the price of aluminum oxide in the first half of the year fell significantly after the Winter Olympics production restrictions and the easing of the impact of the summer epidemic.

Table 3 List of New Domestic Alumina Production Capacity from 2017 to 2023 and Long Term

It is expected that the newly invested alumina production capacity will reach 12.9 million tons in 2022. As the production capacity continues to increase rapidly in the second half of the year, there may be downward pressure on the subsequent price of alumina.

The actual production of alumina in 2021 was 77.171 million tons, and the total production from January to October 2022 was 68.1782 million tons, an increase of 5.1% compared to the same period last year. It is expected that the annual production will reach 81.1 million tons. The consumption of lime per ton of alumina is about 200kg, and the demand for lime in 2022 is about 16.22 million tons.

Table 4 Statistical Table of Aluminum Oxide Production from 2020 to 2022

3) Calcium carbide: The downstream of the domestic calcium carbide industry is mainly concentrated in PVC production, with an apparent consumption of approximately 27 million tons/year of calcium carbide in the past five years. The demand for PVC is steadily increasing, and it is conservatively expected that PVC's demand for calcium carbide will maintain a compound growth of 3% in the next five years. Driven by biodegradable plastic PBAT, BDO is expected to maintain rapid growth. Currently, there are up to 220 BDO projects in operation, under construction, and planned in China, and preliminary work has been carried out. By the end of 2029, the expected production capacity will exceed 17.5 million tons. It is predicted that by 2025, the BDO of the calcium carbide route will consume 4.2 million tons of calcium carbide per year. Assuming that other demands for calcium carbide remain unchanged, the domestic demand for calcium carbide in the coming years is estimated to be approximately 27 million tons in 2022 and 31.5 million tons in 2023, with a domestic consumption of approximately 33.85 million tons by 2025.

The demand for lime in the three major industries mentioned above in 2022 is approximately 155.2 million tons, which is basically the same as the previous year. Due to macroeconomic impact, these industries are in a state of low profit or loss, coupled with high prices of coal and other fuels. The lime industry as a whole is in a state of low profit, and enterprises without supporting limestone mines are in a difficult situation. Many enterprises have limited production or even stopped production.

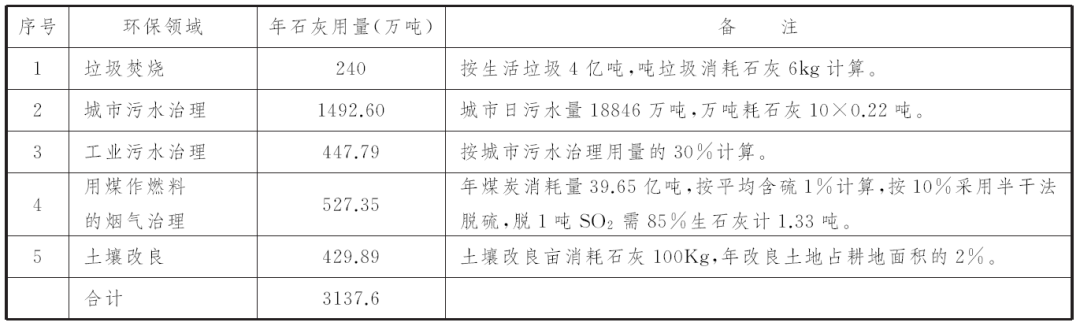

(2) Sustainable growth of environmental protection and agricultural lime

During the 14th Five Year Plan period, China will comprehensively carry out the treatment of air, water, soil, and new pollutants, promote ecological protection and restoration, and achieve pollution reduction and capacity increase. Green development and the construction of a beautiful China will push the environmental protection industry to a new level. In developed countries, the proportion of lime used for environmental protection and agriculture is over 20%, while in China, the proportion of lime used for environmental protection and agriculture is less than 10%. Lime, as a highly active alkaline agent with high cost-effectiveness and no secondary pollution, has been widely used in fields such as waste gas, wastewater, solid waste treatment, soil improvement, and has become an important economic growth point for China's lime industry. During the 14th Five Year Plan period, environmental protection and agricultural ash will form an incremental market with an annual demand of over 30 million tons. The estimation of lime consumption in some environmental protection fields is shown in Table 5.

Table 5 Estimation of Lime Consumption in Some Environmental Protection Fields

2、 Construction status of rotary kiln

As of now, there are approximately 580 lime and dolomite rotary kilns that have been built and put into operation in China that have been included in the statistical approach. According to preliminary statistics from key enterprises of the Lime Association, approximately 25 lime rotary kilns are expected to start construction in 2022, with a production capacity of approximately 8 million tons after production. The newly added production capacity accounts for a relatively high proportion of all kiln types.

3、 Characteristics and Development of Rotary Kiln Technology

1. Technical characteristics of rotary kiln

(1) Lime has the highest quality: calcination is the most uniform, activity is the highest, raw calcination is the lowest, and S content is the lowest;

(2) Maximum single machine production capacity: up to 2000t/d per machine;

(3) The most flexible adjustment: open calcination, with independent and controllable preheating, calcination, and cooling stages;

(4) The range of particle size of limestone entering the furnace is wide: 10-20mm small particle size and 40-80mm large particle size limestone, which can still ensure high-quality calcination when entering the furnace;

(5) Multi fuel mixed combustion: Rotary kiln fuel has strong adaptability, and available fuels include gaseous, liquid, and solid states, which can be burned alone or in combination, and can be freely switched;

(6) Can achieve ultra-low emissions: Among the existing kiln types, rotary kiln is the most mature environmentally friendly ultra-low emission process at present, with stable and mature desulfurization and denitrification processes and low operating costs.

2. Innovation in Rotary Kiln Technology

(1) Rapid progress in large-scale rotary kilns

In the newly built rotary kiln production line in 2022, there will be 3 kilns with a diameter of 5.8 meters and a daily output of 1600 tons; Two kilns with a diameter of 5.2 meters and a daily output of 1300 tons (put into operation in November). The above kiln types are all original designs in China and have a large technological span. After these new rotary kilns are put into operation, they will have a significant impact on lime production equipment in China and even the world.

(2) The energy consumption of the rotary kiln is gradually decreasing

In recent years, the heat consumption of newly built rotary kilns has gradually decreased, with benchmark heat consumption indicators below 1050kcal/kg. Measures to reduce consumption:

1) Standardize operational management, improve personnel quality and management level;

2) Reduce the air leakage rate of the rotary kiln system;

3) Improve the thermal efficiency of the preheater and cooler, and reduce the temperature of exhaust gas and ash discharge;

4) Optimize refractory materials to reduce heat dissipation loss of the cylinder;

5) Fully utilize thermal energy, such as drying coal powder with kiln exhaust gas, producing steam or hot water for secondary utilization, and radiating heat from the calcination section for heating, bathing, etc;

6) Improve burner burnout rate and thermal efficiency;

7) Using frequency converters to reduce electrical energy consumption;

8) Adopting an intelligent combustion control system, optimizing operating procedures, reducing fuel consumption and production costs.

4、 Existing problems and solutions

1. Uneven levels of production line construction

The rotary kiln lime production line is the most complex among the existing lime kiln types, with high requirements for construction units. However, there are many units engaged in rotary kiln construction in China, with varying levels, resulting in poor construction quality and operational effectiveness of some production lines. To ensure the quality of production line construction, it is recommended to choose a professional construction unit. A professional construction unit should have a professional team with professional design capabilities to ensure reasonable factory planning and processes, strong manufacturing capabilities to ensure production quality and progress, a skilled installation team to ensure installation quality and progress, and a professional debugging team to ensure trial production safety and meet production standards in a short time. Secondly, owners should not blindly pursue low prices, but should pay attention to the cost-effectiveness of production line investment to avoid losses caused by frequent shutdowns and renovations. Thirdly, the Lime Association should strengthen consulting services and guide enterprises to correctly select construction units based on their own situations and needs.

2. Insufficient awareness of the importance of raw fuel conditions among lime production enterprises

The smooth operation of the furnace is directly related to the raw materials and fuels. Not all limestone can enter the rotary kiln for calcination, and there are a series of indicator requirements such as composition, particle size, hardness, and mud content; Fuel has various requirements such as calorific value, volatile matter, coke residue characteristics, moisture, fineness, ash content, etc. The stable and high yield of the rotary kiln production line must have stable and qualified raw fuel conditions.

3. Lack of high-end talents in the industry

Due to historical reasons, lime enterprises are generally small in scale and have low overall employee quality, which restricts their development. Advocating industry enterprises to strengthen employee training. The quality of employees and teams is a key factor in ensuring smooth production and excellent indicators. Cultivating and retaining talents is the most cost-effective investment for enterprises.

5、 Market Analysis and Prospect Prediction of Rotary Kiln

1. Market Analysis of Rotary Kiln

As the world's largest industrialized country, China currently has a wide variety of lime kiln types, and rotary kilns have won the trust of many users due to their unique advantages. With the innovative development of rotary kiln technology, its share in the high-end activated lime market will continue to expand.

(1) Rotary kiln lime is preferred for stainless steel, special steel, and steelmaking in the steel industry; As the energy consumption of rotary kilns decreases year by year, the range of rotary kiln ash used in sintering has expanded year by year, such as Jiuquan Iron and Steel, Jingye Iron and Steel, and Xinxing Cast Pipe.

(2) High activity lime improves the recovery rate of alumina and reduces production costs. At present, the alumina industry mainly relies on rotary kilns as direct supporting furnaces, and it has become an industry consensus to select high-end rotary kiln lime for alumina production.

(3) The number of supporting rotary kilns for technological transformation in the calcium carbide industry has been increasing year by year, which not only reduces process power consumption, but also utilizes the advantages of multi fuel mixed combustion in rotary kilns to directly use blue carbon dust removal ash as fuel for combustion, solving the problem of environmental pollution.

(4) The low sulfur content of rotary kiln exhaust gas, mature denitrification processes, and lower denitrification costs are conducive to the promotion and application of rotary kiln technology.

2. Prospect prediction

The transformation of lime production organization and operation mode will become an opportunity for the development of rotary kilns.

(1) With industrial collaboration and capital restructuring, lime enterprises will move towards collectivization and large-scale transformation

Limestone mining, lime, heavy calcium, calcium hydroxide, light calcium, nano calcium carbonate, and derivatives are interrelated and complementary industries. Integrated enterprises will fully recycle and utilize solid waste, waste heat, exhaust gas, etc. in production, with more cost advantages and more guaranteed product quality. With the gradual integration of the industry, large-scale integrated comprehensive enterprises will become a trend.

In recent years, the lime industry has gradually entered the perspective of capital. The association has taken the initiative to establish a lime industry fund to promote industry transformation and upgrading. Local governments are actively promoting enterprise mergers and acquisitions to change the "scattered, disorderly, and polluted" situation of lime and upstream and downstream enterprises. It is expected that in the next 5 years, there will be tens of millions of tons of lime enterprise groups in the industry, and high-end lime kiln types such as rotary kilns will dominate the backbone enterprises.

The downstream demand side of lime, such as steel, calcium carbide, alumina, etc., will have super large customers in the future with industry restructuring. It is not ruled out that there will be mutual shareholding between upstream and downstream large customers.

(2) The arrival of 5G will change the operation mode of lime production enterprises

The basic construction of China's 5G infrastructure will be completed. During the 14th Five Year Plan period, the widespread application of big data technology in the industrial sector will change the company's operational ecology. The lime industry should be proactive and integrate into this big data industrial revolution. It is expected that big data will change the operation mode of lime production enterprises in the following two aspects: firstly, big data will support the industry to establish a unified service platform, including remote diagnosis and technical service support, spare parts and maintenance service platform, unified finished product sales and raw fuel supply platform. Secondly, the intelligent control system is combined with the company's big data platform to gradually achieve intelligent factories and reduce personnel demand. The establishment of a unified service platform and big data platform is conducive to leveraging the technological advantages of rotary kilns.

The development of the times and technological progress have provided broad development space for the development of rotary kilns, and the market prospects are promising.

6、 Development Trend of Rotary Kiln Technology

On November 2, 2022, the Ministry of Industry and Information Technology, the National Development and Reform Commission, the Ministry of Ecology and Environment, and the Ministry of Housing and Urban Rural Development jointly issued the "Implementation Plan for Carbon Peak in the Building Materials Industry". The plan proposes that during the 14th Five Year Plan period, significant progress has been made in the structural adjustment of the building materials industry, energy-saving and low-carbon technologies in the industry continue to be promoted, and the unit energy consumption and carbon emission intensity of key products such as cement, glass, and ceramics continue to decrease, The comprehensive energy consumption level per unit product of cement clinker has been reduced by more than 3%. During the 15th Five Year Plan period, significant breakthroughs were made in the industrialization of green and low-carbon key technologies in the building materials industry, and the level of raw material and fuel substitution was significantly improved. A green and low-carbon circular development industry system was basically established to ensure that the building materials industry achieves a "carbon peak" by 2030.

To achieve the above goals, rotary kiln technology must be innovatively developed:

1. Promote large-scale rotary kilns and reduce energy consumption

The large-scale lime kiln is an effective means to reduce fuel and electricity consumption. According to incomplete statistics in China, rotary kilns above 800t/d save about 10% energy compared to rotary kilns below 600t/d. Therefore, it is recommended to promote rotary kiln production lines with a capacity of over 800t/d based on market conditions.

2. Application of alternative fuels such as biomass energy

Many large lime multinational companies internationally are actively developing alternative fuels, such as waste fuels, hydrogen energy, biomass fuels, etc. Currently, the proportion of alternative fuels used exceeds 20% to significantly reduce carbon emissions from energy combustion processes.

The fuel adaptability of the lime rotary kiln production line is strong. If there are abundant waste fuels and biomass fuels near the production line, suitable alternative fuel utilization methods can be selected based on resource characteristics, partially or completely replacing conventional fuels to reduce the use of conventional fuels and reduce carbon emissions.

3. Application of oxygen rich combustion technologyAfter adopting oxygen rich combustion, the fuel is burned more fully, the amount of smoke is reduced, and the heat generated per unit of fuel is greatly increased, which is beneficial for saving fuel resources. But it is necessary to solve the problem of controlling the increase of nitrogen oxides in the exhaust gas and the air volume required for lime cooling. The solution is to combine oxygen enrichment, reduce air consumption, reasonably introduce kiln exhaust gas, increase CO2 concentration in the exhaust gas, and utilize CO2 resources. However, the investment in its process route equipment is huge, and it needs to be implemented with a reasonable industrial chain economy, such as raising the carbon trading price to a reasonable level or applying it in high-altitude hypoxic areas.

4. Developing energy-saving processes, energy-saving hosts, and adopting energy-saving equipment to improve the energy-saving level of production lines

The continuous optimization of the production line process route, the improvement of energy conservation and efficiency of main engines such as preheaters, rotary kilns, and coolers, and the use of high-efficiency products for fans and motors can further reduce the energy consumption level of the production line.

5. Adopting intelligent control to stabilize the overall energy consumption level

The same equipment, different operators and management levels, and energy consumption indicators vary greatly in China. Improving the intelligence level of production lines, especially by adopting intelligent combustion control systems, can reduce human factors and stabilize the energy consumption level of production lines.

6. Develop and promote efficient utilization technology for low-temperature waste heat

Due to differences in calcination methods, the heat consumption of rotary kilns is relatively high compared to advanced kiln types. If the waste gas from the kiln tail and the waste heat from the kiln skin can be reasonably utilized, the disadvantage of high energy consumption of rotary kilns will be overcome, and the overall energy consumption of the industrial chain will be reduced. Ultra low emissions and denitrification are examples of the advantages of rotary kilns.

7. Promote the industrial application of carbon dioxide capture, utilization, and storage technology

Regardless of fuel and electricity, each ton of lime calcination can generate 0.78 tons of CO2. The lime industry is a major CO2 emitter, and the process is designed reasonably to produce high concentrations of CO2 in the kiln exhaust gas. According to different regions, reasonable CO2 resource utilization methods should be selected, such as industrial and food CO2, production of baking soda, salicylic acid, etc., to reduce greenhouse gas emissions.